Are you looking for a quick and easy way to get some cash in Kenya?

Whether you need money for an emergency, a business idea, or a personal expense, you don’t have to worry about long queues, tedious paperwork, or high-interest rates.

Thanks to technology, you can now access instant loans from your smartphone, anytime and anywhere.

There are many loan apps in Kenya that offer genuine instant loans, with minimal requirements and flexible repayment terms.

In this article, we will review some of the best loan apps in Kenya for genuine instant loans, and help you choose the one that suits your needs.

We will also give you some tips on how to use these loan apps responsibly and avoid getting into debt. Read on to find out more.

Click here to also read about How to Increase your Fuliza Limit: Everything you Need to Know.

10 Best Loan Apps in Kenya

Branch

The Branch credit platform is a loan app in Kenya that doesn’t perform CRB checks.

Both local and international registration on the platform is free.

Users can secure personal loans ranging from Ksh. 500 to Ksh. 300,000 through the Branch app.

The repayment period spans from 62 days to a year, and interest rates vary from 2% to 18%, determined by the customer’s risk profile.

Notably, the Branch app does not impose late fees or rollover fees.

Zenka

In Kenya, a lot of borrowers opt for the Zenka app to receive loans directly in their M-Pesa accounts.

The first loan comes with no interest and no service fee.

You only need to repay the borrowed amount within the specified time, typically 61 days.

To get started, download the app to your phone from the Zenka website, Google Play store, or App Store.

Once you’ve filled out the application form and successfully registered, you can expect to receive the loan in less than five minutes.

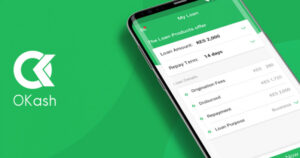

Okash

The Okash credit platform in Kenya offers personal and business loans, providing up to Ksh. 60,000.

Simply download the app from the Google Play Store, install it, and register to access instant loans.

Your loan limit and payment period are determined by the personal details you provide during registration. Okash charges an annual interest rate of 14% on its loans.

Tala

Tala stands out as one of the top loan apps in Kenya that doesn’t check with CRB.

It has garnered substantial downloads and positive user ratings.

With a credit limit of up to KSH 50,000, you can apply once and borrow as frequently as necessary. Simply download the Tala app from the Google Play Store, register, and access loans.

The app verifies your details during registration before depositing the loan into your M-Pesa account.

Repayment can be done in a lump sum or in installments using M-Pesa Xpress or Paybill number 851900.

Timiza Loan App

The Timiza app, developed by ABSA Bank, is available to both ABSA customers and non-customers who meet the eligibility criteria.

Users can borrow amounts ranging from a minimum of Ksh. 1,000 to a maximum of Ksh. 150,000, making it one of the loan apps in Kenya with the most generous loan limits.

Timiza loans come with an interest rate of 1.29%, along with a 5% processing fee and a 20% excise duty on the processing fee. The repayment period for Timiza loans is set at 30 days.

Mshwari loans on Safaricom’s M-pesa app

This mobile loan service is seamlessly integrated with the Mpesa app, and all you need to access the loans is to register for Mshwari.

The loan amounts range from a minimum of Ksh. 100 to a maximum of Ksh. 50,000, and the approved loan is deposited directly into your Mpesa account.

Mshwari loans come with a one-time interest rate of 7.5%, along with an additional 1.5% excise duty on the borrowed amounts. The repayment period for the loan is 30 days.

Moreover, Mshwari offers the option to save money in a dedicated account, with savings earning an annual interest rate of 6.5%.

Fuliza Mpesa

Fuliza is a mobile loan service seamlessly integrated into your Mpesa app, aiming to help you complete transactions even when your Mpesa account lacks sufficient funds. It allows you to top up funds for activities like sending money or making purchases.

There is no specific minimum amount you can borrow from Fuliza, but the maximum amount available is Ksh. 70,000.

Fuliza charges a 1% access fee on all borrowed amounts, in addition to an interest rate ranging from Ksh. 0 to 25 per day.

iPesa Loan App

The iPesa loan app provides credit ranging from Ksh. 500 to Ksh. 50,000 without any service fees.

The repayment period for the loan is between 91 to 180 days, with an annual interest rate ranging from 36% to 72%.

To access the loan, download the iPesa app, install it on your phone, register with your M-Pesa number, and request a loan.

Timely repayment of your credits can gradually elevate your loan limit to as much as Ksh. 50,000.

KCB mobile app

The Kenya Commercial Bank offers a mobile banking platform known as the KCB mobile app.

This app offers a convenient and secure method to manage your KCB account, send money, withdraw cash, and apply for loans.

It’s important to note that the KCB mobile app operates independently from the bank’s other mobile money service, KCB M-pesa, which is associated with Safaricom.

MCo-op Cash Loans

This loan app is a creation of the Cooperative Bank of Kenya. Apart from providing credit services to the bank’s customers, it offers access to various banking features, including cash transfers.

The minimum loan amount available on the app is Ksh. 1,000, while the maximum loan application is set at Ksh. 500,000. The loan comes with an interest rate of 1.083% and a 3% appraisal fee.

With a Mco-op Cash loan, you have the flexibility to choose your repayment period, whether it’s 1, 2, or 3 months. The total cost of the loan will depend on the repayment duration you select.

How To Choose the Right Loan App in Kenya

Mobile loan apps vary, so the service you receive from one may differ from another. However, the common ground is their ability to provide quick credit facilities. Consider the following factors:

- Interest Rates and Fees: Generally, all loan apps in Kenya charge higher interest rates and fees due to the increased risk associated with issuing collateral-free loans. Nonetheless, there are variations, so if you aim to minimize costs, explore loan apps with lower interest rates and fees.

- Loan Term And Repayment Options: Before accepting the loan terms, ensure you thoroughly understand them. Some loan apps may have unfavorable terms that may not align with your preferences. Be sure to read the terms carefully. Additionally, different loan apps offer varying repayment options. Some are more flexible and user-friendly than others, so familiarize yourself with the repayment options before making a decision.

- Reputation And Customer Reviews: Consider a loan app’s reputation, as you wouldn’t want to deal with hidden fees or uncooperative practices. Explore customer reviews in the Google Play Store or Apple Store to gauge the app’s reputation. Previous customers’ experiences can provide insights into what to expect.

- App’s User-friendliness And Customer Support: Ease of use is crucial, as different developers create these loan apps, leading to varying levels of user-friendliness. Opt for an app that is easy to navigate for a seamless borrowing and repayment experience. Additionally, prioritize loan apps with responsive customer support to address any concerns promptly.

Conclusion

Embark on a journey towards financial empowerment with these trusted loan apps in Kenya.

In our exploration of the best platforms offering genuine instant loans, we’ve unveiled a world of financial possibilities tailored to your needs.

Say goodbye to the waiting game and hello to swift solutions that put you in control. Your financial freedom is not just a dream; it’s a reality waiting to be embraced.

Choose the right loan app today and step confidently into a brighter, more financially secure future.