How do you file Nil Returns?

Filing tax returns is a legal obligation for every person or business in Kenya with a valid KRA PIN.

However, not everyone has a source of income or taxable transactions in a given year.

In such cases, you need to file nil returns to declare that you have not paid any taxes for that year.

This article will guide you on how to file nil returns on the KRA iTax portal, the requirements, the deadline, and the benefits of doing so.

Click here to also read about Reprinting your KRA PIN Certificate: Learn How To Reprint KRA PIN Certificate On KRA iTax Web Portal.

What Do You Need to File KRA Returns Successfully?

To file your KRA returns, you’ll need your KRA PIN and your iTax password.

How to file nil returns

Filing nil returns is an easy process that doesn’t need any expertise. All you need to have is a phone, laptop, or a desktop and an internet connection.

Follow these steps to file your nil returns:

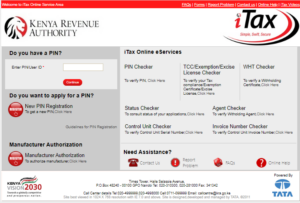

Step 1: Visit the KRA iTax portal

Go to the KRA website’s portal section.

Have your login credentials ready.

Click here to access the portal.

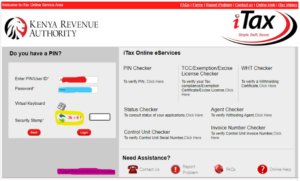

Step 2: Enter your KRA PIN and password

Key in your KRA PIN in the User ID/PIN section and proceed to enter your iTax portal password.

You’ll be asked to prove you’re human by solving an arithmetic question, known as the security stamp.

Click Log in after entering the correct details.

NOTE: If you’ve forgotten your password, select “Forgot password/unlock account.” You’ll receive a password recovery link and a KRA PIN reset guide via email.

Step 3: On the Returns tab select File Nil returns

After logging in successfully to your account, click on “Returns” and choose “File NIL returns” on the drop-down menu.

In the type section, select “Self.” As for the Taxpayer PIN, the system will automatically fill in your KRA PIN.

In the Tax Obligation section, choose “Income Tax – Resident.” Click “Next” to proceed.

Step 4: Income tax-return period page

The system will take you to the income tax return period page where a message will pop up after clicking submit.

Read the message that pops up and click ok.

Step 5: KRA returns receipt

You have successfully filed your Nil returns.

You will receive the receipt in your email. It is advisable to retain these KRA Returns receipt emails or print the forms as evidence that you have successfully filed your KRA returns online by clicking on “Download Returns receipt.”

Frequently Asked Questions about KRA Returns

Can I file my KRA returns using my phone?

Sure, you can submit your returns using your smartphone by installing the iTax app available on the Google Play Store.

Who is eligible for nil returns in Kenya?

Individuals who are not engaged in any business activities or not in gainful employment can file nil returns

How much are KRA penalties for NIL returns?

Under the Tax Procedures Act, failing to file returns and late filings result in KRA penalties. If you neglect to file NIL returns for unemployed students, you are liable to pay a penalty of 5% of the tax due or Kshs. 2,000 (whichever is higher). This penalty structure applies equally to employed individuals

Bottom Line

Filing nil returns is a simple and quick process that can save you from penalties and inconveniences.

By following the steps outlined in this article, you can file your nil returns on the KRA iTax portal in a matter of minutes.

Remember, the deadline for filing nil returns is June 30 of the following year.

Filing nil returns will also help you maintain a good tax compliance record and access various government services.

Don’t wait until the last minute, file your nil returns today and enjoy peace of mind.

ALSO READ:

- KRG The Don: The Real Name, Age, Wife, and Net Worth of Kenya’s Controversial Musician

- How to Start a Movie Shop Business in Kenya: A Step-by-Step Guide for Aspiring Entrepreneurs

- 20 Most Profitable Business Ideas to Start in Kenya With Different Capital

- How to Launch a Successful Wines and Spirits Business in Kenya: A complete Guide